Cryptocurrency exchanges have become the backbone of digital finance, empowering millions of users to buy, sell, and trade crypto assets globally. For startups, entrepreneurs, and investors, launching a crypto exchange opens the door to new revenue opportunities and long-term growth. This blog will guide you through everything you need to know — from what a crypto exchange is to the tech stack, legal compliance, and why white label solutions are ideal for rapid market entry.

What Is a Cryptocurrency Exchange?

A cryptocurrency exchange is a digital platform where users trade crypto assets like Bitcoin, Ethereum, and stablecoins. These platforms come in different forms:

Centralized Exchanges (CEXs): Run by a single authority, offering high liquidity, simple UI, and fast transactions.

Decentralized Exchanges (DEXs): Operate without intermediaries, allowing peer-to-peer trading and greater user control.

Hybrid Exchanges: Blend the control of CEXs with the transparency of DEXs.

Cryptocurrency Exchange Development?

Cryptocurrency exchange development refers to the technical process of designing, building, and deploying a trading platform with essential features such as:

Real-time trading engine

Multi-currency wallet integration

Secure KYC/AML compliance modules

Liquidity aggregation

Admin and user dashboards

Whether you’re building from scratch or using a white label, your platform must be secure, scalable, and user-centric.

Recommended Tech Stack for a Crypto Exchange

A solid tech foundation ensures stability and future scalability. Here’s a commonly used tech stack for crypto exchange development:

Frontend: React.js / Angular / Vue.js

Backend: Node.js / Python / PHP / Go

Database: MongoDB / PostgreSQL / Redis

Blockchain Integration: Web3.js / Ether.js / Binance API / Bitcoin Core

Wallet Integration: Multi-signature wallets, cold storage, hot wallets

Security Protocols: AES encryption, 2FA, DDoS protection, SSL, JWT

Infrastructure: AWS / Google Cloud / Kubernetes for scalability

Choosing the right tech stack ensures your exchange handles high-volume transactions without performance drops.

Legal & Regulatory Compliance

Compliance is a crucial part of launching a crypto exchange. Without it, your business can face fines, shutdowns, or legal action. Key areas to focus on:

KYC/AML Implementation: Identity verification and anti-money laundering processes.

Licensing: Depending on your region, obtain licenses like MSB (Money Services Business) in the US or EMI licenses in the EU.

Data Privacy: Align with GDPR or equivalent local data laws.

Tax Compliance: Enable tax reporting based on your user’s jurisdiction.

Risk Assessment: Continuous monitoring of wallet activity to prevent fraud.

Consult with a legal advisor who specializes in blockchain regulations to ensure full compliance from day one.

White Label Crypto Exchange: The Fastest Path to Market

If time-to-market and budget efficiency are your priorities, a White Label Crypto Exchange Development solution is the smart choice.

Benefits:

Ready-to-deploy architecture

Complete branding customization

Pre-built features: trading engine, wallets, KYC, liquidity

Saves months of development time

24/7 technical support & scalability

Startups can launch a fully operational exchange in just a few weeks — without compromising on quality or security.

Revenue Models for Crypto Exchanges

Running an exchange can be highly profitable if structured right. Here are the key revenue streams:

Trading Fees: Fixed or percentage-based fees per transaction

Listing Fees: Projects pay to list their tokens

Withdrawal/Deposit Fees: Earn on every user transaction

Margin Trading & Lending: Offer leveraged trading for advanced users

Subscription Plans: Charge for premium features or tools

With multiple monetization channels, your exchange can achieve long-term sustainability.

Why Now Is the Time to Launch a Crypto Exchange

Crypto adoption is growing fast, and yet the market still holds room for niche platforms, regional leaders, and specialized exchanges. The reasons to launch now:

Increased institutional interest

Supportive regulatory clarity in several countries

Emerging markets and untapped user bases

DeFi and NFT integrations creating new use cases

Early movers in underserved markets often become dominant players.

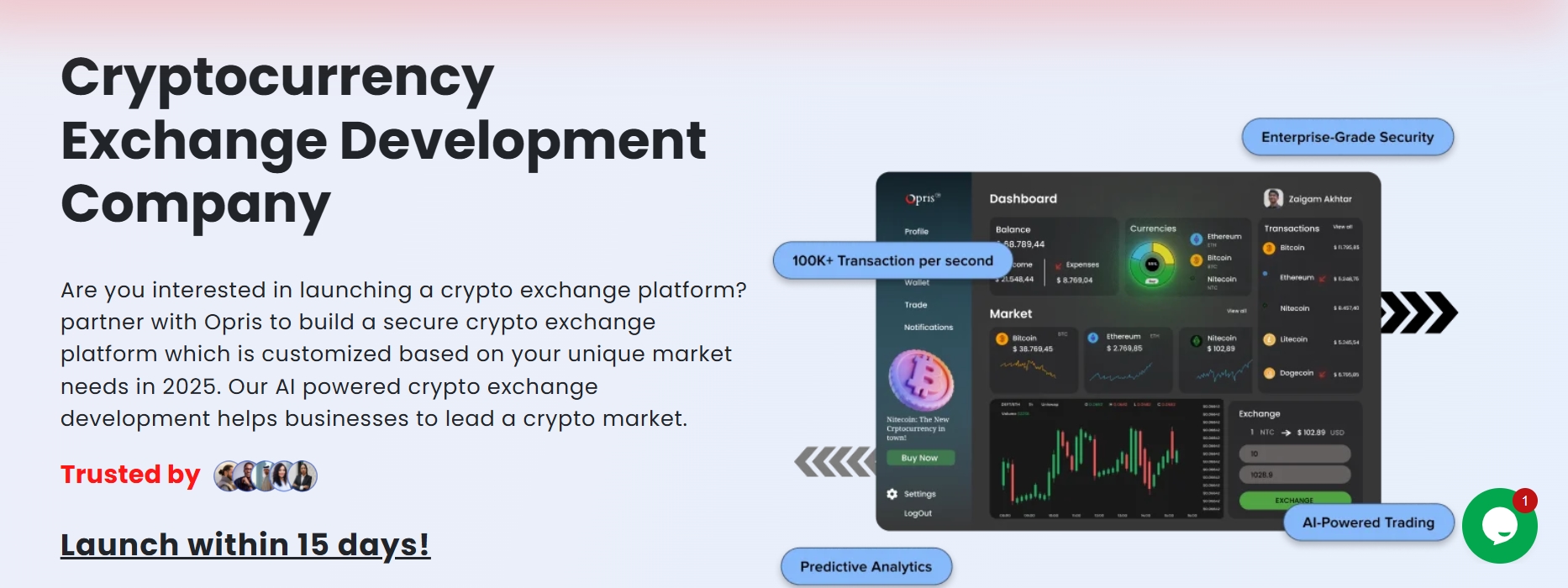

Partner with Opris: Your Cryptocurrency Exchange Development Company

At Opris, we offer tailored cryptocurrency exchange development services — from concept to launch. Whether you’re building a fully customized platform or opting for a white label exchange, our experts ensure:

Enterprise-grade security

High-performance trading engine

Customizable UI/UX

Regulatory readiness

Ongoing maintenance and upgrades

As a trusted cryptocurrency exchange development company, we’ve helped startups, enterprises, and investors create scalable and profitable exchange platforms worldwide.

Final Thoughts

Crypto exchanges are more than just trading hubs — they’re long-term business opportunities. With the right technology, legal foundation, and go-to-market strategy, your exchange can become a cornerstone of the digital finance ecosystem.

Ready to launch? Partner with Opris — the experts in cryptocurrency exchange development.