The Solana price has shown impressive upward movement recently, reflecting strong bullish momentum similar to that of Bitcoin and Ethereum. If you’re following the Solana coin price, here’s an insightful look into where it could be headed, based on recent market behavior and ecosystem developments.

Solana’s Bullish Run: Key Resistance Levels

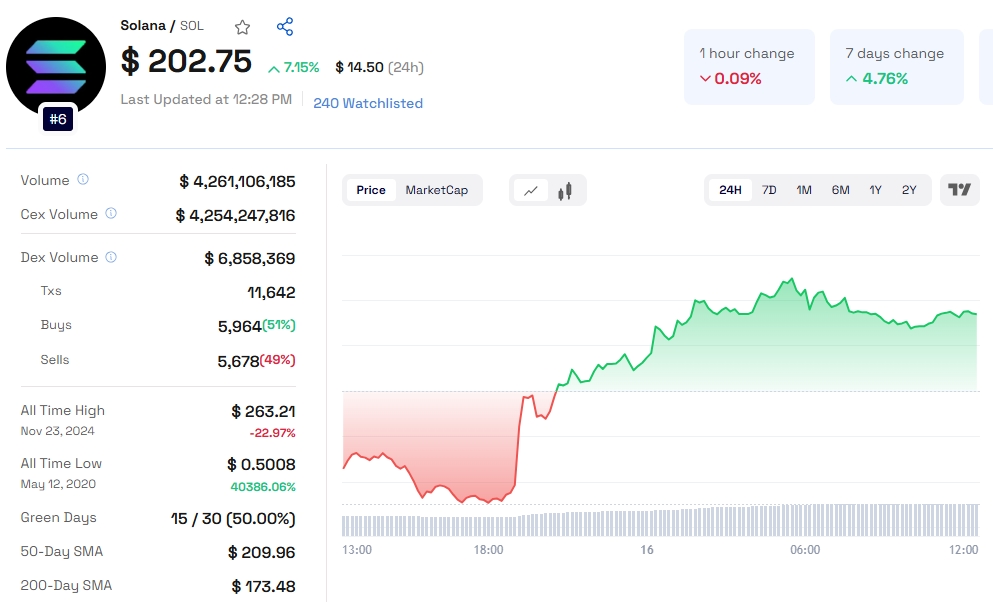

After forming a solid base above $175, the Solana crypto price quickly broke through key resistance levels. It moved past $180, $185, and even hit the $200 mark. The price of Solana peaked at $206 before experiencing some consolidation.

Support: The current price is stabilizing near the 23.6% Fibonacci retracement level, a common technical indicator used to forecast future price moves.

Resistance: The Sol price prediction suggests that if it can break through the $205 resistance, the next target will be $212, followed by $220. A close above $220 could push the price even further, potentially heading towards $232 and $245.

If you’re tracking Solana price today, it’s crucial to keep an eye on these resistance zones.

Potential Downward Movement

Not all is rosy, though. If Solana fails to surpass $205, it might see some downside movement. Here are the key levels to watch for:

Immediate Support: The Solana coin price has support near $196. If this level breaks, the next support zone sits around $190.

Major Support: A more significant pullback could see Solana dropping to $185, and if it falls below this, it may test $172.

For traders, understanding these support levels and resistance zones is essential for making informed decisions.

Also read: Pepecoin Price Prediction 2030

Solana’s Dominance in the DEX Market

One of the driving factors behind Solana price stability is its dominance in the decentralized exchange (DEX) market.

DEX Trade Volume: In Q4 2024, Solana processed an impressive $219.2 billion in DEX trade volume, surpassing Ethereum’s $184.3 billion.

Memecoin Market: Solana has also made a huge mark in the memecoin market, contributing to approximately $3.093 billion in fees, with platforms like Raydium responsible for 56% of that activity.

This dominance strengthens the Sol price prediction, showing that the Solana ecosystem is thriving despite recent volatility.

Institutional Interest: Solana ETFs on the Horizon

Institutional adoption of Solana could have a major impact on the Solana coin price. Several high-profile financial firms, including Grayscale Investments and VanEck, have filed for Solana-based ETFs with the SEC.

Estimated Inflows: JPMorgan estimates that Solana ETFs could attract $3–6 billion in assets during their first year of operation.

Timeline: Initial rulings for these ETFs are expected between January 23 and 25, 2025.

Such institutional moves are likely to further boost the Sol price prediction in the coming months.

Solana’s Ecosystem Growth

Beyond just price movements, Solana’s ecosystem continues to show significant growth, reinforcing its potential for future gains. Key areas of expansion include:

AI Market Leadership: Solana currently holds 56.48% of the AI agent market with a market capitalization of $8.44 billion.

The Solana price has shown impressive upward movement recently, reflecting strong bullish momentum similar to that of Bitcoin and Ethereum. If you’re following the Solana coin price, here’s an insightful look into where it could be headed, based on recent market behavior and ecosystem developments.

Conclusion: What’s Next for Solana?

With strong bullish momentum and continued ecosystem growth, the Solana price has a promising outlook. Keep an eye on the following:

Watch for potential resistance at $205 and $220.

If the price breaks below $190, be cautious as it could test lower levels around $172.