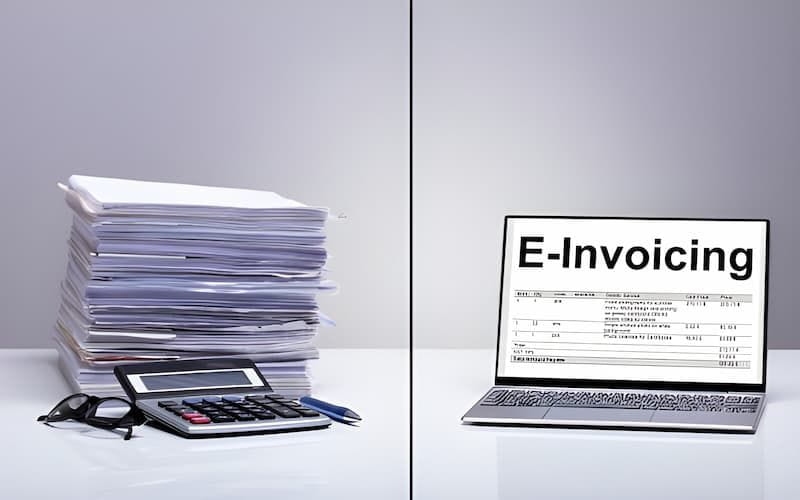

Digitizing invoices through the replacement of the traditional paper-based invoices is no longer an option to companies in Saudi Arabia but a strategic need. E-invoicing in Saudi Arabia has a lot of advantages, as it is faster, less prone to errors, enhances compliance, and the management of cash flow. A change in the paper-based systems can be a challenging task, however, when the correct strategy and tools such as Quickdice ERP are used, companies can change the paper-based systems to electronic ones with ease and without complications.

These are seven steps that Saudi businesses should follow to successfully go through with e-invoicing.

1. Evaluate Your Current Process of Invoicing

It is important to know your existing invoicing process before introducing E-invoicing in Saudi Arabia. Determine every phase of invoice preparation, authorization, delivery, and remittance. Identify areas of inefficiency, bottlenecks, and human error prone areas.

Mapping out the processes you have will help you to have a clear picture of what should be digitized. Incorporating these lessons into Quickdice ERP will make sure the online system is a mirror of your business reality and the transition will be much easier.

2. Select the optimal E-Invoicing Solution

Not everything is an e-invoicing solution. The Saudi companies are to choose the software that meets the requirements of the ZATCA (Zakat, Tax and Customs Authority) and has an option to integrate with the existing systems, as well as provides real-time tracking and analytics.

Quickdice ERP offers a powerful system that easily connects e-invoicing with accounting, inventory, and financial processing systems. This will guarantee that invoices are precise, adherent, and automatically updated in every department.

3. Digitize Invoice Templates and Workflows

The second one is to computerize your invoice templates and approval processes. Eliminate manual forms and use standardized digital templates to keep consistency and regulatory compliance.

The Quickdice ERP allows companies to computerize the production of invoices, forward them to approvals, and send them to the clients electronically. This will minimize errors in manuals and speed up billing.

4. Train Staff on E-Invoicing Procedures

An effective transition must be ensured by ensuring that employees are aware of the use of the new system. Conduct training about creating, authorizing, and managing online invoices. Exemplify the difference between E-invoicing in Saudi Arabia and paper-based procedures, the compliance and the automatization.

Quickdice ERP enables the staff to master the integrated workflow, being a combination of invoicing and financial reporting, inventory management, and analytics, the learning curve is reduced.

5. Ensure Compliance with Saudi Regulations

In e-invoicing, compliance is a major consideration. The format and reporting requirements of the invoices should be in accordance with ZATCA. Failure to comply may lead to fines or loss of payment.

With the help of Quickdice ERP, Saudi businesses will be able to create invoices that meet the requirements of the regulatory authorities automatically, monitor the statuses of submissions, and keep documentation that would comply with the requirements set by the authorities. This guarantees smooth audit process and fines are avoided.

6. Test the System before full implementation.

Pilot phase Carry out a pilot phase prior to the roll out of the new e-invoicing system to test the system. Send sample invoices, verify the correctness of the data and ensure that automatic working processes do not malfunction.

Quickdice ERP also offers sandbox environment and testing systems where the businesses can simulate the invoice processing without affecting the actual business processes. This is done to help identify and rectify the potential issues before full scale deployment.

7. In-Service and Performance Review

Test and implement fully E-invoicing in Saudi Arabia in your organization. Monitor the key performance indicators of the system, such as the duration of time to process invoices and the error and payment cycle rates.

Quickdice ERP provides real-time dashboards, and they provide information on financial performance, approvals pending to be made, and compliance status. The round-the-clock monitoring helps the businesses to optimize the processes, productivity, and offer convenient digital invoicing services.

Conclusion

Digitization of invoicing through the adoption of digital invoices instead of paper invoices is a revolution to Saudi businesses. Through these seven steps, which include evaluation of existing processes, identification of the appropriate solution, automation of processes, employee training, compliance testing, testing, and performance monitoring, companies will be able to get all the benefits of E-invoicing in Saudi Arabia.

By combining the process and Quickdice ERP, the efficiency is improved even more, the errors are minimized, and the compliance with the local regulations is realized smoothly. Companies that adopt the same change not only enhance operational efficiency, but also put themselves in a position of achieving better financial controls, expedited payments and long term expansion in a more digitalized economy.