QuickBooks Journal Entry Guide: How to Create & Manage Easily

Getting a handle on your bookkeeping begins with grasping the concept of a QuickBooks Journal Entry and its significance. These entries are the backbone of accurate financial data, whether you're tweaking payroll, fixing errors, or reallocating funds between accounts. A lot of QuickBooks users find themselves asking questions like "What is a Journal Entry in QuickBooks?" or "How do I make a Journal Entry in QuickBooks Online?" This guide aims to answer those questions, covering everything from the basics to the nitty-gritty of creating one. We'll also take a closer look at the General Journal Entry process within QuickBooks, so you can manage your transactions with confidence, without any uncertainty.

What Is a Journal Entry in QuickBooks?

A journal entry is essentially a manual accounting transaction, a way to debit one account while crediting another. These entries are frequently employed for a variety of purposes: To adjust balances. To correct errors in the accounting records. To document depreciation. To allocate expenses. To move funds between different accounts. While QuickBooks and similar software typically handle most financial activities automatically, manual journal entries provide the flexibility to make precise adjustments when the need arises.

Why Journal Entries Matter in Accounting

Even though QuickBooks automates payroll entries, invoices, bills, and payments, there will always be situations in which manual entries are necessary. Knowledge of how entries operate also helps to ensure: Correct financial reporting; updated general ledger; clean balance sheets; appropriate tax preparation; and clear audit trails.

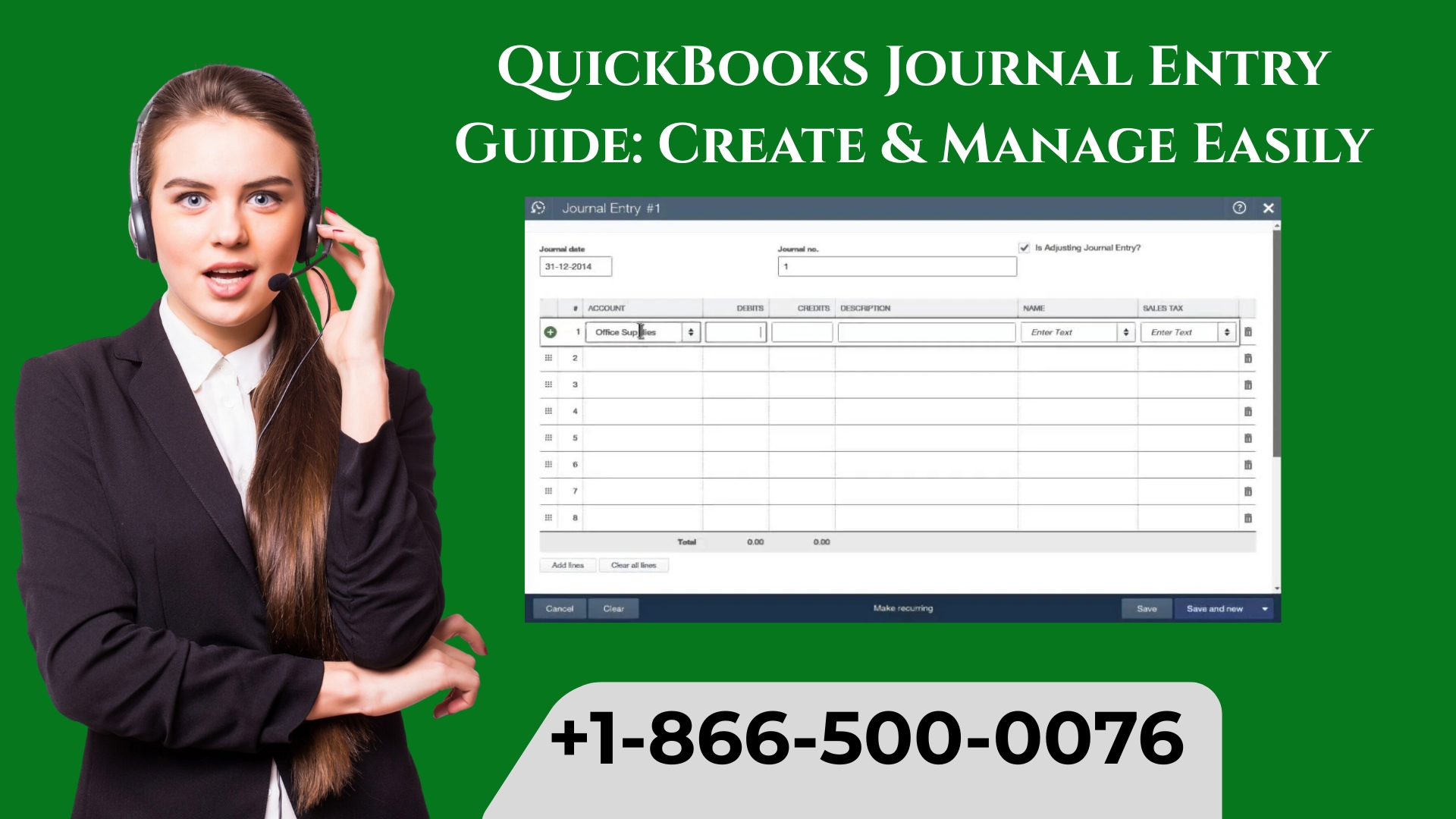

How to Make a Journal Entry in QuickBooks Online

The most basic guide for both novice and expert users is provided below:

Detailed Instructions

1. Visit the page for the journal entry.

Log in to QuickBooks Online.

On the left sidebar, select + New.

Choose a Journal Entry.

2. Type in the Transaction Information

Two lines for credits and debits will be visible to you. Include:

Account

Debits

Give credit to

An explanation

Location/Class (if tracking is enabled)

3. Confirm that Debit = Credit

Debits must equal credits for a journal entry to be saved correctly. If the entry is not balanced, QuickBooks will not let you save the transaction.

4. Pick the Appropriate Date

Select the appropriate accounting period at all times. Financial statements may be impacted by shifting historical periods.

5. Keep the Entry

Select "Save and Close" or "Save and New." Your general ledger now has the entry.

General Journal Entry QuickBooks: Best Practices

In QuickBooks, creating a general journal entry involves more than just debits and credits. Adhere to these recommended practices:

Steer clear of using journal entries for vendor and customer transactions.

Accurate reporting and automation are maintained by QuickBooks forms (invoices, bills, and payments).

2. Make Adjustments Using Journal Entries

For example:

Year-end modifications

Depreciation

Accrual entries

Allocations of expenses

3. Include Detailed Descriptions

To facilitate upcoming reviews or audits, each line should contain a succinct but understandable explanation.

4. For Complex Entries, Speak with an Accountant

It's safer to have an accountant create or review the entry if you're not sure.

How to Create a Journal Entry in QuickBooks Online for Common Scenarios

1. Modifying the Sales Tax

Credit: Sales Tax Expense; Debit: Sales Tax Payable

2. Documenting Depreciation

Debit: Depreciation Credit for Expense: Accrued Depreciation

3. Correcting Inaccurate Expense Reporting

Credit: Incorrect Expense Account; Debit: Correct Expense Account

4. Moving Assets or Bank Accounts

Receiving Account Debit

Sending Account Credit

How to Edit or Delete Journal Entries in QuickBooks

Occasionally, entries must be modified. Here's how to deal with them:

Modifying an Entry

Navigate to Chart of Accounts under Settings.

Locate the impacted account.

Select "Run Report."

Find the journal entry.

Select Edit.

Eliminating a Submission

Get the entry open.

At the bottom, click "More."

Choose "Delete."

Common Errors When Creating Journal Entries

Even seasoned bookkeepers make errors. Keep an eye out for these:

Using journal entries rather than the appropriate formats

Neglecting to balance credits and debits

Choosing the incorrect accounting period

Reconciliation-locked account adjustments

Perplexing asset and expense classifications

How to Steer Clear of These Mistakes

Regularly review your chart of accounts.

Closed accounting periods should be locked.

Give each journal line a description.

Monthly account reconciliation

For advanced entries, hire an accountant.

QuickBooks Online vs Desktop: Journal Entry Differences

Online QuickBooks

cloud-based

Contemporary interface

Posting more quickly

Perfect for teamwork

Desktop QuickBooks

Increased personalization in accounting

Options for batch entry

Features for complex reporting

Nonetheless, full journal entry functionality is available in both versions.

Need Help? Professional Support Available

If you're facing issues related to QuickBooks journal entries or technical errors such as Windows Firewall Is Blocking QuickBooks, expert support is just a call away. Our team helps resolve accounting issues, connectivity problems, and QuickBooks performance errors quickly.

Conclusion

Accurate financial records are guaranteed when you learn how to create, modify, and maintain a QuickBooks journal entry. The procedures listed above will help you remain accurate and confident whether you need to fix a mistake, make year-end adjustments, or figure out How to Make a Journal Entry in QuickBooks Online. Always adhere to best practices and seek advice from your accountant when necessary, particularly in complex situations.

FAQs

1. Why do I need to create a journal entry in QuickBooks?

To correct balances, allocate expenses, or record adjustments not captured by standard forms.

2. Can I reverse a journal entry?

Yes. QuickBooks allows you to reverse an entry, creating an opposite-entry automatically.

3. Do journal entries affect reports?

Absolutely. They update your general ledger, balance sheet, and profit-and-loss reports.

4. Should I use journal entries for customer invoices?

No. Always use invoices, payments, and bills for customer/vendor transactions.

5. Can beginners create journal entries?

Yes, but seek accounting guidance when handling complex transactions.