Struggling with IRS Form 1040? File It Right

Learn how to fill out IRS Form 1040 correctly with step-by-step guidance, schedules, and examples from BooksMerge to file accurately and maximize refunds.

BooksMerge exists to give small business owners their time and confidence back. We provide a powerful combination you won't find elsewhere: your own dedicated bookkeeping expert paired with simple, intuitive software, all for a clear, affordable price. Your dedicated professional becomes your trusted partner, handling your bookkeeping, payroll, and taxes with precision and care. Meanwhile, our platform gives you a real-time view of your financial health, transforming complex numbers into clear insight. This seamless blend of human expertise and smart technology eliminates the stress of financial management. We deliver the reliability you need to make confident decisions and the exceptional service you deserve, freeing you to focus entirely on what you do best—running and growing your business.

Learn how to fill out IRS Form 1040 correctly with step-by-step guidance, schedules, and examples from BooksMerge to file accurately and maximize refunds.

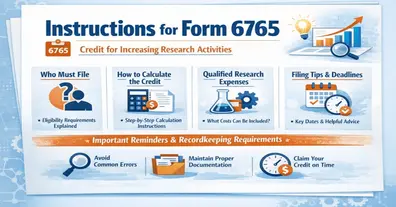

Clear, up-to-date Form 6765 Instructions for claiming the R&D tax credit in 2026. Learn QREs, payroll offset, ASC vs regular method, documents required, and recent changes.

Form 6765 Instructions explain how businesses calculate and claim the Research & Development Tax Credit using IRS guidelines to support innovation-related expenses and activities.