Form 6765 Instructions explain how to claim the federal R&D tax credit, report qualified research expenses, and elect payroll-offset or reduced credit options — vital for innovators and startups.

Table of Contents

Introduction — Quick overview

What is Form 6765 used for?

Who qualifies for R&D tax credit?

What are QREs?

How to calculate ASC vs regular method

Documents required to support a claim

Can startups use payroll offset?

What changed in 2025 (and the 2026 mindset)?

Step-by-step Form 6765 Instructions — practical filing tips

Best practices and recordkeeping

Conclusion

FAQ

Introduction

This article gives practical, search-friendly Form 6765 Instructions you can use right now. I wrote it to be clear, human, and useful — no fluff, just reliable guidance and links to official sources. If you’d like help preparing the form, BooksMerge offers experienced R&D tax support — call +1-866-513-4656.

What is Form 6765 used for?

Form 6765 lets businesses claim the federal Credit for Increasing Research Activities (the R&D credit), elect a reduced credit under section 280C, and elect to use part of the credit as a payroll tax offset for qualifying small businesses. These uses and the form layout follow official IRS guidance.

Who qualifies for R&D tax credit?

To qualify, activities must meet the four-part test: (1) permitted purpose; (2) elimination of uncertainty; (3) technical in nature; and (4) process of experimentation. Eligible entities include corporations, partnerships, S corporations, and certain startups — but eligibility requires documented QREs and business purpose. See IRS guidance for details.

What are QREs?

Qualified Research Expenses (QREs) commonly include:

Employee wages for those performing or supervising R&D.

Supplies used in research.

Contract research paid to outside parties (limited percentage included).

Certain rental or lease costs tied to research.

QRE definitions come from IRC §41 and the Form 6765 instructions — track wages, invoices, and project-level costs carefully.

How to calculate ASC vs regular method

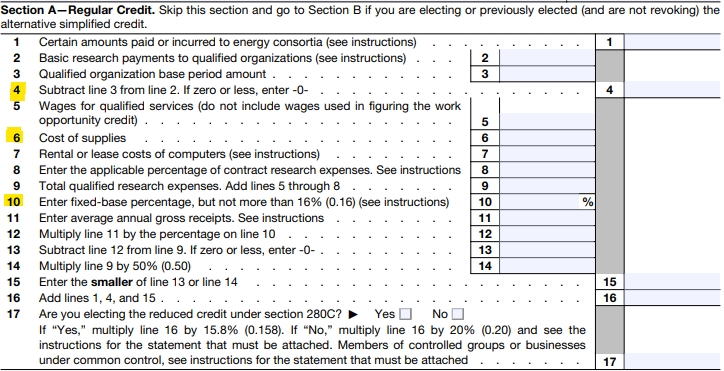

Form 6765 supports two main calculation methods:

Regular (Traditional) Method

Compute current year QREs.

Compute base amount (using prior years’ QREs and gross receipts formula).

Credit = (Current QREs - base amount) × statutory percentage.

Use Form 6765 Part I for regular method calculations.

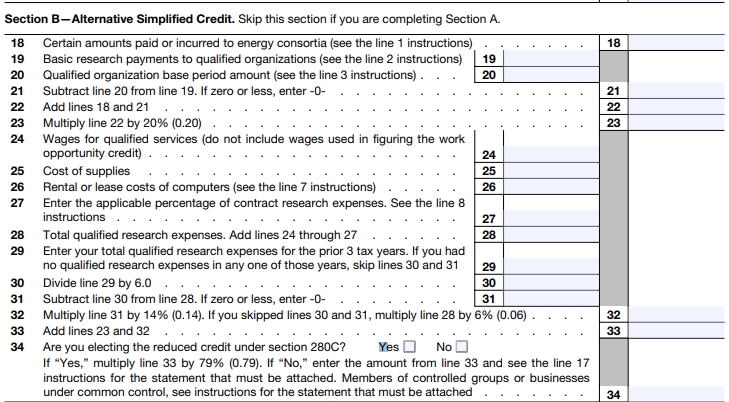

Alternative Simplified Credit (ASC)

ASC uses a simpler base tied to average QREs for the prior three years.

Credit = 14% of QREs above 50% of that average (or 6% if no prior QREs).

Use Form 6765 Part II to elect ASC. ASC often reduces bookkeeping complexity but can change credit size — model both methods to see which yields a better result.

Documents required

Prepare to attach and retain:

Payroll records tied to R&D activities (job descriptions, timesheets).

Project-level cost ledgers and invoices for supplies.

Contracts and statements for third-party research.

Design notes, test plans, prototypes, and sampling/statistics plans if you use sampling.

Financial statements showing QRE allocation across business components.

The IRS now asks for more detailed component-level reporting in some cases; keep granular records.

Can startups use payroll offset?

Yes — qualified small businesses (generally with average gross receipts under specified thresholds) may elect to apply up to $250,000 of the R&D credit annually against the employer portion of social security payroll taxes, subject to eligibility rules and elections on Form 6765. This payroll offset can help startups with little or no income tax liability to realize the value of R&D credits sooner.

What changed in 2025 (and the 2026 mindset)?

Key 2025 developments and the 2026 mindset:

The IRS revised Form 6765 and issued updated instructions (January 2025), requiring more information in several new sections and increasing transparency expectations for R&D claims.

The IRS delayed mandatory reporting for some new Section G business-component details for tax year 2025; Section G remains optional for 2025 filers, and many enhanced requirements now phase in for tax year 2026. Taxpayers should prepare for full compliance in 2026.

Legislative and administrative changes in 2025 impacted R&D deduction and credit treatment (example: laws affecting capitalization vs immediate expensing), so evaluate both tax-year rules and elections before filing. Consult your advisor and check authoritative guidance.

Quick Tip: Complete IRS form list for 2026: all essential tax forms, instructions, and filing tips for individuals and businesses in one easy-to-access guide.

Step-by-step Form 6765 Instructions — practical filing tips

Choose method: Model regular vs ASC; pick the one that maximizes credit after considering documentation cost.

Map projects to business components: Create a short list of projects and business components to attach if required. Start doing this now for 2026 readiness.

Gather evidence: Collect timesheets, invoices, contracts, and project docs. Keep one folder per business component.

Document sampling plans: If you use statistical sampling for employee time or costs, prepare and retain the sampling methodology. The IRS now asks for more transparency here.

Elect payroll offset if eligible: Use the election lines on Form 6765 and confirm eligibility thresholds.

Attach required schedules: Complete the relevant parts of Form 6765 and attach to your tax return. Keep backup documents for 3 to 7 years per standard retention rules.

Best practices and recordkeeping

Use project codes in payroll and timesheets so wages map directly to QREs.

Keep contemporaneous technical documentation — test results, failure analysis, spec changes.

Maintain clear invoices from contractors showing work performed and deliverables.

Run an internal pre-filing review to catch common issues and consider a specialist’s comfort check. These habits reduce audit risk and speed up claims.

For helpful reading on small business financial literacy and data-driven decision making, you may find this BooksMerge resource useful: financial literacy statistics — it ties financial discipline to stronger credit substantiation.

Conclusion

Follow these Form 6765 Instructions to claim the R&D credit with confidence: choose the best credit method, document QREs at the project level, prepare for expanded reporting in 2026, and consider payroll-offset options if you are a qualifying startup. If you want hands-on help, BooksMerge specializes in bookkeeping, tax and R&D credit preparation — reach out at +1-866-513-4656.

FAQ

Q: What is Form 6765 used for?

A: To compute and claim the Credit for Increasing Research Activities, elect the reduced 280C option, and elect a payroll tax offset for qualifying small businesses.

Q: Who qualifies for R&D tax credit?

A: Businesses that perform qualified research meeting the four-part test and that incur QREs — includes corporations, partnerships, and eligible startups. Check IRC §41 and Form 6765 Instructions.

Q: What are QREs?

A: QREs include employee wages for R&D work, supplies used in research, and contract research payments (subject to limits). Keep payroll and project records.

Q: How to calculate ASC vs regular method?

A: ASC uses a simpler average-of-prior-years base and often lowers recordkeeping; the regular method uses a statutory base tied to gross receipts and prior-year QREs. Model both in Form 6765 Parts I and II.

Q: What documents are required?

A: Payroll records, timesheets, invoices, contracts, technical notes, sampling plans, and any business-component documentation the IRS may request.

Q: Can startups use payroll offset?

A: Yes — qualifying small businesses can elect to use part of the R&D credit to offset employer payroll taxes (subject to limits and elections on Form 6765).

Q: What changed in 2025?

A: The IRS issued an updated Form 6765 and new instructions in 2025 with more granular reporting; some new requirements delayed to tax year 2026, so use 2025 to prepare.

If you want, I can convert these Form 6765 Instructions into a printer-ready checklist, a worksheet to calculate ASC vs regular method, or draft the cover letter and attachments for your return — tell me which and I’ll prepare it.

Read Also: Form 6765 Instructions