In 2023 and 2024, Solana (SOL) witnessed a remarkable surge, rising from below $10 in January 2023 to an impressive all-time high of $268 by November 2024. As the year progresses, talks of Solana price potentially reaching $500 circulate. However, recent Sol crypto price movements suggest that caution is needed.

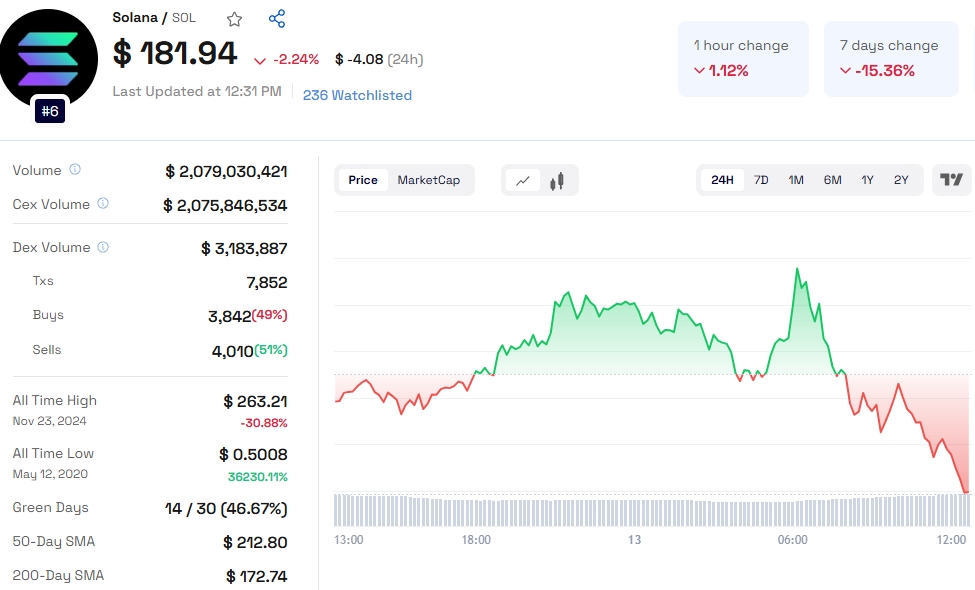

As of now, Solana price today sits at $186, following a sharp decline. Traders have taken profits, leading the Sol coin price to dip into the $180-$200 range. This presents an opportunity for those looking to buy Solana at a discount, but the question remains: can it bounce back and reach new heights in 2025?

Technical Analysis: What’s Next for Solana Price?

Looking at the Solana price chart, the current trend reveals several key levels to watch for.

Resistance levels: SOL faces significant resistance around $190 and $192. If the price of Solana breaks through these levels, the next targets are $200, $212, and potentially even $225.

Support levels: On the downside, Solana price now is being supported at $182 and $180. If SOL fails to stay above these support levels, it could head further down toward $175 or even $162.

The Sol price prediction largely depends on how SOL handles these critical price zones. A successful push above $200 could set the stage for a new bullish run, while failure to break resistance may lead to more losses.

Also Read: VET Price Prediction 2025, 2026 – 2030

Whale Activity and Market Sentiment

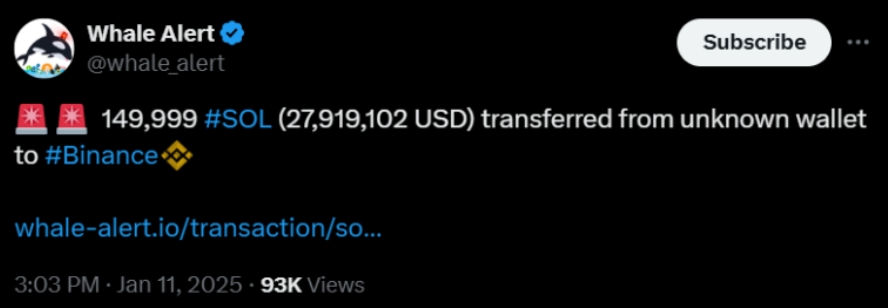

One of the factors impacting Solana price is large transfers made by whales. Recently, a transfer of 149,999 SOL and 245,922 SOL to Binance has caught attention. Such large movements often indicate a possible sell-off, which could temporarily depress Solana crypto price.

Potential Impact of Whale Activity:

149,999 SOL worth millions could be sold on the market.

245,922 SOL was recently moved to Binance, raising concerns about a large sell-off.

These whale movements can significantly influence Solana coin price, especially if they lead to a market-wide sell-off. However, it’s important to note that whales may not necessarily be looking to sell immediately; they could be preparing for staking, lending, or rebalancing their portfolios.

Derivatives Market and Increased Open Interest

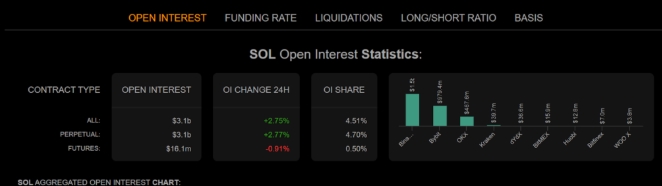

The rise in derivatives activity also suggests more market volatility ahead. The open interest in Solana’s derivatives market increased by 2.75% in the last 24 hours, now standing at $3.1 billion.

Binance leads with $1.5 billion in open interest.

Bybit follows with $979.4 million.

OKX has $467.6 million in open interest.

This increase in open interest indicates more traders are positioning themselves for potential price movements, which could lead to higher volatility and more significant price shifts in the coming weeks.

Is Now the Right Time to Buy Solana?

With Solana price today hovering near the $186 mark, investors are asking: is it time to buy SOL at a discount? Based on the current market dynamics, here are the key takeaways:

Bullish Scenario: If SOL breaks above $200, it could move toward $212 and $225, bringing us closer to the all-time high of $268 and possibly beyond.

Bearish Scenario: A failure to break resistance at $190 could lead to a decline toward $175 or $162, especially if market sentiment turns negative.

For those looking at Sol price prediction, buying near the support zones could provide a good entry point, but be mindful of the potential risks associated with whale activity and increased market volatility.

The Solana price prediction for 2025 remains a topic of debate. While there are bullish sentiments among Solana backers who believe SOL can retest its all-time highs, caution is advised due to current market conditions and whale activities. Monitoring key support and resistance levels, as well as tracking open interest in Solana derivatives, will be crucial for predicting SOL's next move.