Imagine a chess grandmaster examining the board and taking his or her next step. These people are not only seeing the moves, but they are reading the whole game, predicting the psychology of the opponent and computing the odds well into the later stages of the game. That is what expert crypto traders do when they look at the price patterns, but their rivals in this scenario are thousands of other traders, algorithms, and market makers who are all competing at once.

Pattern recognition is usually the difference between profitable traders and those who blow accounts. The kind that is not just memorizing the textbook crisp, but the more insightful knowledge as to know why those crisp do function and why they are likely to fail at certain times. Then it becomes a matter of knowing how to read between the lines of the market talk.

The Evolution of Digital Pattern Analysis

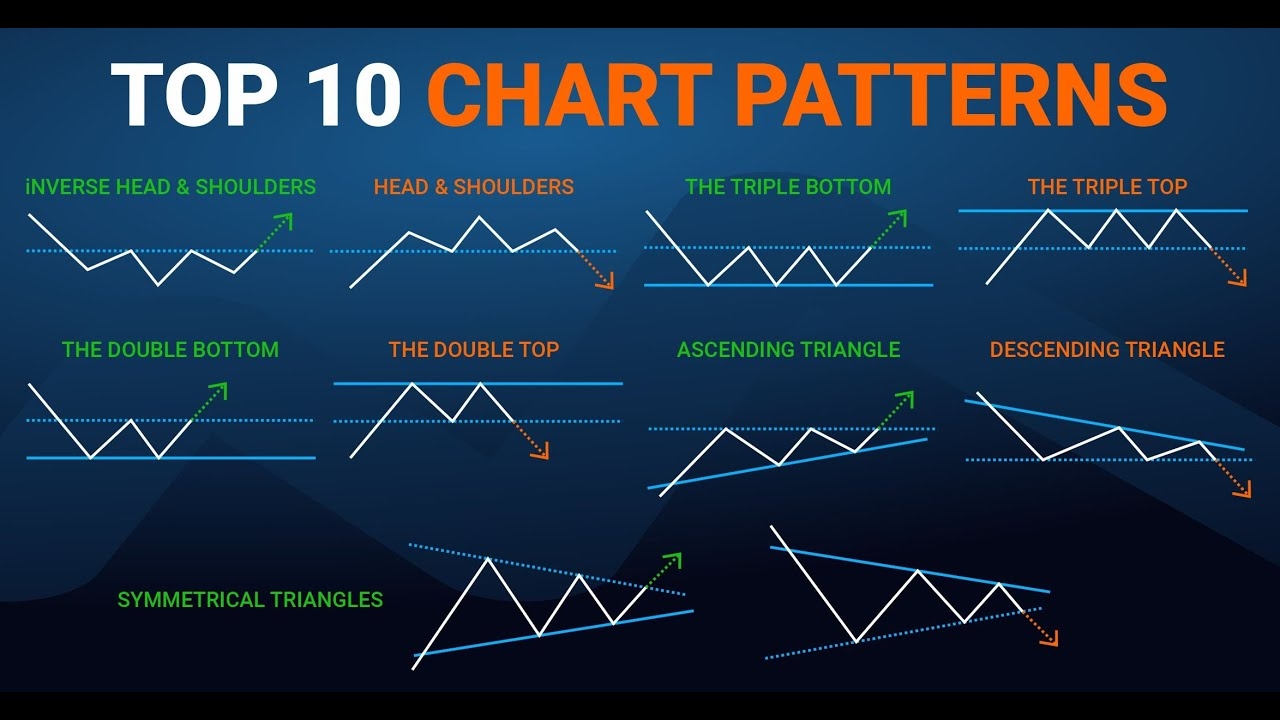

The types of Chart patterns crypto markets present have changed considerably as compared to those of stocks because of the peculiarities of digital assets. The cycle of trade 24 hours a day, the universal accessibility and heavy retail involvement introduce warps in patterns that need modified interpretation techniques.

Chart patterns crypto tend to be executed quickly as compared to the traditional ones. The time frame of a head and shoulders formation that may take months to form in stocks, in crypto, can be done in a few weeks. This increasing speed exposes the trader to speed and risk since they lack the time to study and respond to any emerging structure.

Algorithmic Pattern Disruption

High-frequency trading algorithms now scan for common patterns and trade against them, creating false breakouts and pattern failures. Smart traders adapt by looking for patterns that algos struggle to identify, like complex multi-timeframe formations or patterns influenced by fundamental catalysts.

Social Media Pattern Amplification

Twitter, Reddit, and Discord communities can accelerate pattern completion through coordinated buying or selling pressure. When influencers highlight specific formations, retail traders often pile in, creating self-fulfilling prophecies that validate the patterns.

Advanced Pattern Recognition Systems

Chart patterns crypto analysis has been revolutionized by machine learning algorithms that can identify subtle formations human eyes miss. These systems analyze thousands of historical patterns to calculate probability outcomes for current formations.

The key insight is that successful pattern trading now requires understanding both classical formations and their modern algorithmic variations. Patterns that worked perfectly in 2017 may fail consistently in 2025 due to changed market structure and participant behavior.

Multi-Asset Pattern Synchronization

Professional traders now analyze patterns across multiple crypto assets simultaneously, looking for confirmation signals. When Bitcoin, Ethereum, and major altcoins all form similar patterns, the probability of successful completion increases significantly.

On-Chain Pattern Validation

Blockchain analytics provide additional pattern confirmation through wallet behavior analysis. Large wallet movements during triangle formations or exchange inflows during flag patterns offer insights unavailable in traditional markets.

Psychological Drivers of Pattern Formation

Market psychology remains the fundamental force behind pattern creation, regardless of technological advances. Fear, greed, and uncertainty manifest as recognizable chart formations because human nature remains constant even as trading technology evolves.

Understanding crowd psychology helps traders anticipate pattern failures. When everyone sees the same obvious formation, it's often too late to profit from it. The best opportunities come from patterns that are forming but not yet widely recognized.

Retail vs. Institutional Psychology

Crypto's retail-heavy structure creates different psychological dynamics than traditional markets. Retail traders often hold positions longer than institutions, creating more pronounced pattern formations but also more violent breakouts when sentiment shifts.

FOMO and Pattern Acceleration

Fear of missing out can accelerate pattern completion in crypto markets. When retail traders see a bull flag forming and social media starts buzzing about potential breakouts, the increased buying pressure often triggers premature pattern completion.

Mining Profitability and Pattern Correlation

The relationship between mining activity and chart patterns reveals fascinating insights about market psychology. What crypto can be mined searches correlate strongly with bullish pattern formations, as retail interest in mining typically spikes during optimistic market phases.

During bear flag or descending triangle formations, mining inquiries drop significantly. This correlation provides contrarian signals for experienced traders who understand that maximum pessimism often precedes major reversals.

Hash Rate Pattern Indicators

Network hash rates often diverge from price action during pattern formation, creating additional confirmation signals. When Bitcoin price forms a descending triangle but hash rate remains stable, it suggests underlying strength despite bearish chart appearance.

Mining Difficulty Adjustments

Mining difficulty changes can trigger pattern breakouts by affecting supply dynamics. When difficulty increases significantly, miners may sell holdings to cover costs, potentially completing bearish patterns. Conversely, difficulty decreases can reduce selling pressure and support bullish breakouts.

Risk Management in Pattern Trading

Pattern trading without proper risk management is like base jumping without a parachute. Even the most reliable formations fail occasionally, and crypto's volatility amplifies both profits and losses from pattern trades.

The psychological challenge of pattern trading lies in accepting that being right 60% of the time with proper risk management beats being right 90% of the time with poor position sizing. It's counterintuitive but mathematically sound.

Dynamic Stop-Loss Strategies

Effective stops in crypto pattern trading require understanding both technical levels and market volatility. Static stops often get triggered by normal market noise, while dynamic stops adjust to changing volatility conditions.

Pattern Reliability Scoring

Experienced traders develop internal scoring systems for pattern reliability based on volume, timeframe, market context, and external factors. Higher-probability patterns justify larger position sizes, while questionable formations warrant smaller allocations.

Integration with Fundamental Analysis

Pure technical analysis misses crucial context that can make or break pattern trades. Regulatory news, adoption announcements, and macroeconomic factors can override technical patterns, creating opportunities for traders who combine both approaches.

The most successful crypto traders use patterns as timing tools rather than directional predictions. They might be fundamentally bullish on an asset but wait for technical patterns to provide optimal entry points.

News-Pattern Interaction

Major news events during pattern formation can either validate or invalidate technical formations. Positive news during bullish patterns often accelerates breakouts, while negative news during bearish patterns can trigger violent completions.

Macro Environment Influence

Interest rate changes, inflation data, and geopolitical events affect crypto patterns differently than traditional assets. Understanding these relationships helps traders anticipate pattern failures before they occur.

Future of Pattern Analysis

Artificial intelligence and machine learning are transforming pattern recognition from art to science. Modern systems can identify patterns with statistical precision that human traders cannot match, but they still require human judgment for context and risk management.

The democratization of advanced pattern analysis tools means retail traders now have access to institutional-grade analytics. This levels the playing field but also increases competition, making edge generation more challenging.

Quantum Computing Implications

As quantum computing advances, pattern recognition capabilities will expand exponentially. Traders who understand these technological shifts and adapt their methods accordingly will maintain competitive advantages.

Decentralized Pattern Analysis

Blockchain-based pattern analysis platforms are emerging, allowing traders to share insights while maintaining anonymity. These systems could revolutionize how pattern information is distributed and monetized.

Conclusion

Pattern analysis in crypto markets represents a fascinating intersection of psychology, technology, and probability theory. The traders who thrive understand that patterns are tools for managing uncertainty, not crystal balls for predicting the future.

Success requires balancing technical precision with psychological awareness, combining historical pattern knowledge with modern market realities. The crypto market's unique characteristics amplify both opportunities and risks, making disciplined pattern analysis more crucial than ever.

Master the fundamentals, respect the risks, and remember that behind every chart pattern lies human psychology expressed through price action. Technology evolves, but human nature remains constant, creating eternal opportunities for those who can read the market's emotional language.