Managing payroll forms like W-2 and W-3 can be a stressful part of running a business, but QuickBooks simplifies the process with its payroll management tools. Whether you’re using QuickBooks Desktop or QuickBooks Online, printing your W-2 and W-3 forms is straightforward. In this guide, we’ll walk you through the steps to print your W-2 and W-3 forms in QuickBooks efficiently and accurately, so you can focus on other aspects of your business. Need assistance during the process? Call QuickBooks support at +1(866)500-0076 for immediate help.

QuickBooks makes printing your W-2 and W-3 forms simple—follow our step-by-step guide to save time and ensure accurate payroll tax filing.

Understanding W-2 and W-3 Forms

Before diving into QuickBooks, it’s essential to understand what W-2 and W-3 forms are.

W-2 Form: Reports an employee’s annual wages and the taxes withheld. Every employer must provide a W-2 to their employees and the IRS.

W-3 Form: Serves as a summary of all W-2 forms submitted by the employer. It’s sent to the IRS along with the W-2 forms.

Printing these forms accurately is crucial for compliance with federal regulations and to avoid any payroll tax penalties. QuickBooks makes generating both forms simple, accurate, and ready for submission.

Step-by-Step Guide to Print W-2 and W-3 Forms in QuickBooks

Step 1: Prepare Your Payroll Data

Before printing forms, ensure all employee payroll information is correct:

Verify employee names, Social Security numbers, and addresses.

Check that year-to-date wages and tax withholdings are accurate.

Reconcile any discrepancies in payroll reports.

Using QuickBooks employee tax forms and employee earnings reports QuickBooks features can help you verify all information before printing.

Step 2: Navigate to the W-2/W-3 Printing Section

For QuickBooks Desktop Payroll:

Go to Employees > Payroll Tax Forms & W-2s > Process Payroll Forms.

Select Annual Form W-2/W-3 – Wage and Tax Statement.

Choose the tax year you want to process.

For QuickBooks Online Payroll:

Go to Payroll > Employees > Payroll Tax Forms & Filings.

Select Annual Forms > W-2/W-3.

Choose the correct year and proceed.

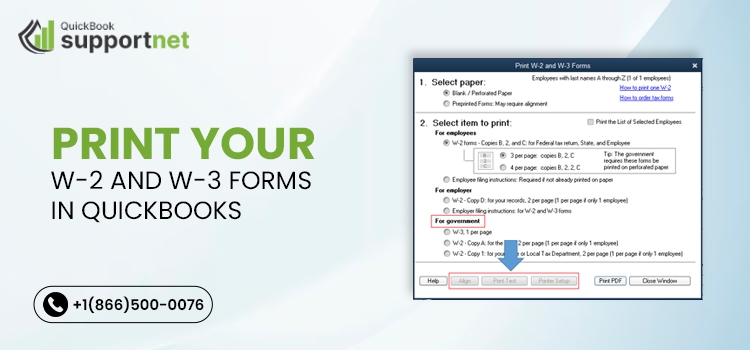

Step 3: Preview and Print the Forms

QuickBooks allows you to preview W-2 and W-3 forms before printing.

Ensure all boxes are correctly filled, including wages, tips, and withholding amounts.

Select the printer and print the forms on official IRS-approved forms for accuracy.

Tip: If you encounter formatting issues, check QuickBooks settings for paper size and print alignment.

Step 4: Distribute Forms to Employees

After printing:

Provide each employee with their W-2 form by January 31st.

Keep copies for your records.

Submit the W-3 form along with W-2 forms to the IRS.

QuickBooks also supports electronic filing, which can simplify distribution and submission for larger teams.

Step 5: File W-2 and W-3 Forms with the IRS

Once printed, you can:

Mail forms physically to the IRS, or

Use QuickBooks online payroll forms feature to e-file directly.

Accurate submission ensures compliance with federal regulations and avoids penalties.

Tips for Smooth W-2 and W-3 Printing in QuickBooks

Update QuickBooks: Ensure you’re using the latest version to avoid errors.

Check Employee Info: Confirm all Social Security numbers and addresses are correct.

Backup Data: Save a backup before processing payroll forms.

Use Official Forms: Only use IRS-approved W-2 and W-3 forms for printing.

Contact Support: For any issues, reach QuickBooks payroll experts at +1(866)500-0076.

Conclusion

Printing your W-2 and W-3 forms in QuickBooks doesn’t have to be complicated. By following these steps, you can ensure accurate payroll reporting and stress-free compliance. QuickBooks provides tools to verify, print, and even e-file your forms, making year-end payroll management much simpler. Remember, if you run into challenges or need immediate assistance, call +1(866)500-0076 to connect with QuickBooks support.

FAQs

Q1: Can I print W-2 forms for multiple employees at once in QuickBooks?

Yes! QuickBooks allows batch printing of W-2 forms for all employees at once, saving time and ensuring consistency.

Q2: What if an employee’s information is incorrect on a W-2?

You can correct errors in QuickBooks and reprint the W-2. Make sure to file corrected W-2 forms with the IRS.

Q3: Can I e-file W-2 and W-3 forms through QuickBooks?

Yes, QuickBooks supports electronic filing, which is faster and reduces the risk of errors.

Q4: Do I need official IRS forms to print W-2/W-3 in QuickBooks?

Yes, for paper filing, you must use official IRS-approved forms to ensure proper alignment and acceptance.

Q5: What years can I print W-2 and W-3 forms for?

QuickBooks allows printing for the current and past years, provided the payroll data exists and is accurate.

Read Also: QuickBooks Form 941