Warm Autoimmune Hemolytic Anemia Drug Pipeline Analysis: a market research perspective

Overview: why this market matters

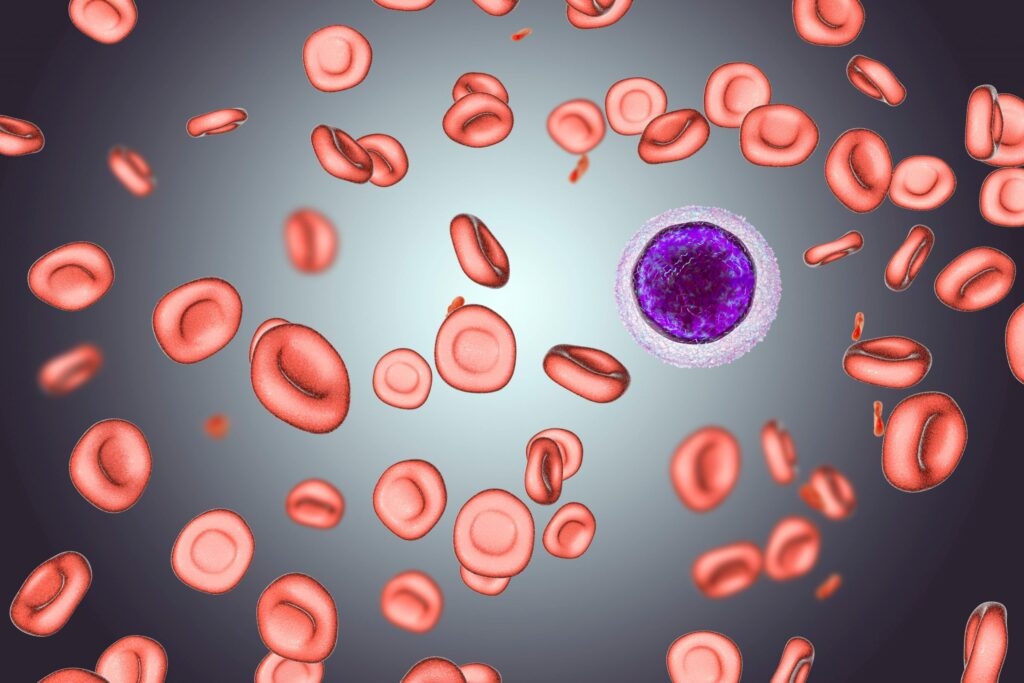

Warm autoimmune hemolytic anemia (wAIHA) represents a focused and clinically urgent niche within hematology where patients suffer from immune-mediated red cell destruction and clinicians often rely on off-label or broad immunosuppression. The absence of therapies specifically approved for wAIHA has concentrated attention on the drug pipeline as companies and investigators pursue targeted, mechanism-driven solutions to an unmet clinical need.

Key components of the pipeline: mechanisms and modalities

The current pipeline is notable for diversity in mechanisms rather than a single dominant approach. FcRn (neonatal Fc receptor) inhibitors aim to lower pathogenic IgG levels rapidly and with an attractive safety profile, positioning them as a mechanistic alternative to broad B-cell depletion. Complement pathway modulators — including proximal inhibitors that blunt complement-mediated red cell destruction — are another active class, offering a distinct biological route for hemolysis control. In parallel, small-molecule kinase inhibitors, proteasome modulators, and repurposed immunomodulators are being evaluated to reduce autoantibody production or mitigate downstream immune activation. This multi-modal pipeline reflects an effort to replace or complement steroids and existing off-label biologics with therapies that are faster acting, more targeted, and potentially safer.

Treatments and technologies in focus

Several therapeutic strategies dominate investor and clinical interest. FcRn blockade is attractive because of its capacity to lower circulating pathogenic IgG without sustained broad immunosuppression. Complement inhibitors — including agents that act upstream in the complement cascade — are being explored for patients whose hemolysis has a significant complement component. Targeted B-cell modulation (including next-generation anti-CD20 approaches and B-cell signaling inhibitors) remains a pragmatic avenue because B cells are central to autoantibody production. Finally, repurposing and combination approaches (for example, adding kinase inhibitors or proteasome inhibitors to established regimens) are being tested to improve response durability and reduce steroid exposure.

Market significance and clinical challenges

The wAIHA pipeline is strategically important because successful approvals would create the first therapies specifically indicated for the disease, changing treatment algorithms and payer dynamics. However, the market faces typical rare-disease challenges: heterogeneous patient presentations, limited prospective randomized trial data, and the need for clinically meaningful endpoints that regulatory authorities accept. Companies must demonstrate not only efficacy in reducing hemolysis but also meaningful improvements in symptoms, transfusion needs, and quality of life while maintaining acceptable safety in a population already vulnerable to infection and comorbidity.

Practical applications and stakeholder value

For patients, targeted pipeline therapies promise quicker symptom control, reduced steroid dependence, and fewer cumulative side effects. Healthcare providers would gain a broader toolkit with more predictable mechanisms and clearer treatment sequencing. For payers and industry, approved, label-supported treatments create more consistent prescribing patterns and potential for differentiated value propositions (for example, rapid onset or steroid-sparing claims). From an R&D perspective, successful programs in wAIHA could de-risk related autoimmune indications and spur additional investment in antibody-mediated disease biology.

The most impactful advances will likely come from therapies that deliver durable remissions with acceptable safety profiles and from diagnostic tools that enable early, precise intervention. As these elements mature, the Warm Autoimmune Hemolytic Anemia Drug Pipeline Analysis will increasingly highlight programs that combine clear mechanistic rationale with demonstrable patient benefit.

Future trends and research directions

Looking ahead, expect the market to evolve along three axes: biomarker-driven patient selection to match mechanism to pathology; combination strategies that pair rapid-acting agents with durable immune modulation; and regulatory innovation around trial design and meaningful endpoints in rare hematologic diseases. Additionally, nearer-term regulatory milestones and orphan designations in the pipeline will shape commercial strategies and partnership activity, influencing which mechanisms consolidate commercial leadership. Continued translational work that clarifies the relative roles of IgG, complement, and cellular immunity in individual patients will determine which pipeline candidates ultimately deliver differentiated clinical value.