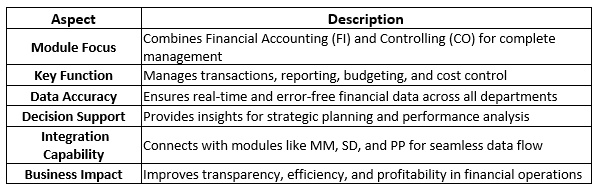

Strong financial management capability inside the SAP ERP system is SAP FICO. Financial Accounting (FI) and Controlling (CO) are combined to control all financial transactions, reporting, and internal cost management. It improves financial performance and helps companies keep openness, precision, and compliance. Real-time data analysis for improved corporate choices and efficiency is made possible by SAP FICO. Many learners join an SAP FICO Online Course to gain strong knowledge of financial management and reporting.

What Is SAP FICO?

Financial accounting and controlling are done in SAP with the help of the module known as SAP FICO. Clear management of corporate financial data and reporting is made possible with it. External accounting, like as balance sheets and profit and loss statements, is treated by the FI section. Internal accounting, that is, cost management and budgeting falls under the scope of the CO.

SAP FICO lets customers follow every business transaction live. Better decision-making is fostered and financial statements are made more accurate. Many companies use SAP FICO to maintain clear and seamless financial operations. It also helps meet legal and tax standards in several nations.

For a whole business solution, the system interacts with other SAP modules including MM and SD. Every firm requires excellent financial management and precise cost monitoring for success, hence SAP FICO specialists are in great demand.

SAP FICO Fundamentals

SAP FICO is an acronym for financial accounting and management. It is a fundamental SAP ERP module that oversees every cost- and financial-related operation in a business. It enables better control and decision-making by means of correct reporting and real-time financial processing. Professionals prefer SAP FICO Online Training to build real-time accounting and controlling skills.

Financial Accounting (FI)

External business transactions are recorded on the FI module. It controls the general ledger, asset accounting, accounts receivable, and accounts payable. It guarantees that across all divisions financial data remains correct and full. The FI module produces income and profit and loss reports as well as balance sheets. It also backs several currencies and nation-specific legal rules.

Controlling (CO)

Internal reporting takes center stage in the CO module. It monitors and controls cost centers, profit centers, internal orders, and product costing. It enables managers to examine the cost flow and monitor performance. The CO module integrates with FI to give a complete perspective of the financial state of the firm.

Integration

Along with MM, SD, and PP, SAP FICO interacts with other modules. This integration guarantees a fluid data exchange between other departments and finance. It gives full insight into activities and keeps every transaction accurate. Consequently, SAP FICO aids dependable financial management and cost management throughout the whole company.

Uses Of SAP FICO In Financial Institutions

Financial institutions run intricate accounting and reporting systems using SAP FICO. It promotes compliance, financial accuracy, and data transparency over several locations and systems. Students enroll in an SAP FICO Course in Delhi to learn practical finance tools used in top companies.

Financial Accounting Applications

Every financial transaction is managed in real time by SAP FICO records. It lowers hand work by automating receivables and accounts payable. It guarantees that every transaction adheres to legal rules and deftly processes general ledger entries. Additionally generates financial statements including income reports and balance sheets. These analyses enable organizations to meet audit demands and remain open.

Controlling and Performance Management

Tracking internal expenses in banks and financial institutions is made easier using the controlling module in SAP FICO. It tracks investment initiatives, profit centers, and cost centers. Additionally, it helps find places where costs could be cut without compromising service quality. Managers examine financial performance and plan budgets efficiently using CO data.

Integration Benefits

SAP FICO works with other SAP components to produce a single financial system. For improved liquidity management, it links with SAP Treasury and Risk Management. This link guarantees a precise risk analysis and cash flow tracking. Financial organizations use SAP FICO to keep compliance and boost financial effectiveness. Experts recommend SAP FICO Training in Delhi for hands-on experience with SAP systems.

Financial Mastery With SAP FICO

SAP FICO's great capacity to handle, analyze, and regulate financial data helps one to achieve financial expertise. Real-time insight into corporate performance is guaranteed together with precise financial management. Working professionals choose SAP FICO Training in Noida to enhance their accounting and analytical capabilities.

1. Strategic Financial Management

SAP FICO helps companies accurately manage complicated accounting operations. The FI module promotes statutory reporting, tax compliance, and worldwide accounting standards. By automating reconciliations and journal entries, it minimizes human mistakes. It also provides prompt financial statements assisting management in making more strategic judgments.

2. Cost Control and Profitability

The CO module allows thorough cost monitoring across divisions. At every level, it tracks income, expenditures, and profitability. It aids in the identification of high-performing areas by means of cost center and profit center accounting. Detailed product costing enables businesses to maximize pricing and lower manufacturing costs with SAP FICO as well.

3. Real-Time Insights and Efficiency

Instant financial insights come from SAP FICO's interaction with production and logistical modules. It guarantees that financial statements correctly reflect every transaction. This real-time interaction increases financial clarity and speeds up decision-making. Through SAP FICO, companies gain financial mastery by matching financial objectives with operational efficiency, therefore laying a solid base for continuous growth and profit.

Conclusion

With SAP FICO financial and cost management operations are fully controlled. It guarantees openness, compliance, and data accuracy in all activities. Companies use it to simplify accounting, manage expenditures, and enhance decision-making. Many aspirants aim for an SAP FICO Certification to validate their skills and boost their career growth. Making it an absolute need for contemporary financial management systems, SAP FICO promotes financial stability and expansion with real-time insights and automation.