Credit Balance Services: Ensuring Compliance and Financial Accuracy in Medical Billing

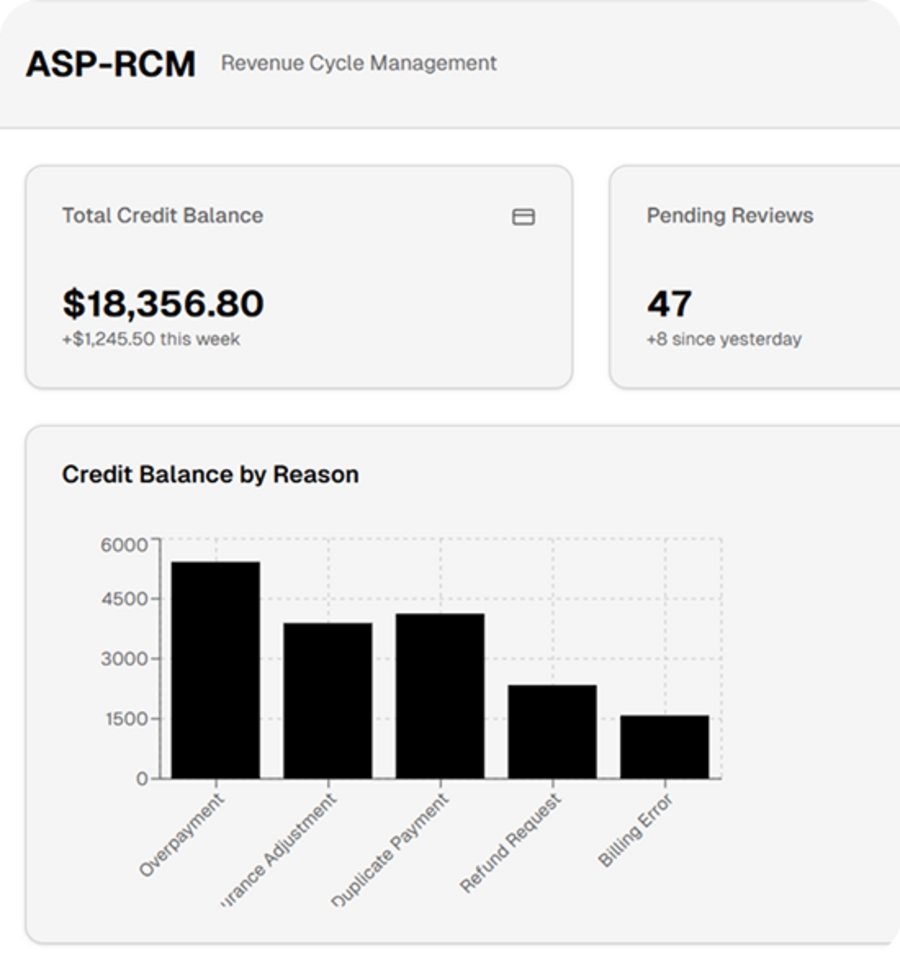

In today’s complex healthcare billing environment, managing credit balances is a critical yet often overlooked component of revenue cycle management. Credit balances occur when payments from patients or payers exceed the amount owed on an account. If not resolved accurately and on time, these balances can create compliance risks, financial liabilities, and audit exposure for healthcare providers.

Professional credit balance services help healthcare organizations identify, analyze, and resolve credit balances efficiently while maintaining full compliance with payer contracts and regulatory guidelines.

What Are Credit Balances in Medical Billing?

A credit balance in medical billing represents an overpayment on a patient account. These overpayments may result from duplicate payments, incorrect charge entry, coordination of benefits issues, contractual adjustments, or billing errors. Credit balances can originate from both patients and insurance payers and must be investigated and resolved promptly.

Regulatory agencies and payers closely monitor unresolved credit balances, making proper adjudication essential to avoid penalties, refunds delays, and reputational risk.

Why Credit Balance Resolution Is Critical

Unresolved credit balances pose significant challenges for healthcare providers. Aging credit balances may trigger payer audits, compliance violations, and revenue inaccuracies. In addition, delayed refunds negatively impact patient satisfaction and trust.

By implementing a structured credit balance resolution process, providers can:

Reduce financial liability and audit risk

Ensure timely and accurate refunds

Improve compliance with CMS and payer guidelines

Maintain clean and accurate accounts receivable

Strengthen overall revenue integrity

Our Credit Balance Services Approach

Our credit balance services are designed to deliver accuracy, compliance, and efficiency. We follow a systematic workflow that ensures every credit balance is thoroughly reviewed and resolved.

1. Identification & Account Review

We analyze patient and payer accounts to identify valid credit balances and isolate the root cause of overpayment.

2. Detailed Adjudication

Each credit balance is reviewed against payer contracts, EOBs, and remittance advice to determine the appropriate action—refund, adjustment, or reapplication.

3. Compliance-Focused Resolution

All actions are completed in strict adherence to payer rules, CMS regulations, and healthcare compliance standards.

4. Refund Processing & Documentation

We ensure timely and accurate refund processing with proper documentation to support audit readiness and transparency.

Benefits of Outsourcing Credit Balance Services

Outsourcing credit balance management allows healthcare providers to focus on patient care while ensuring financial accuracy. Key benefits include:

Faster credit balance resolution

Reduced administrative burden on internal teams

Improved audit preparedness

Lower compliance risk

Enhanced patient satisfaction through timely refunds

Our experienced revenue cycle specialists bring deep knowledge of medical billing regulations and payer requirements, ensuring consistent and reliable outcomes.

Who Can Benefit from Credit Balance Services?

Our credit balance services support a wide range of healthcare providers, including:

Physician practices

Behavioral and mental health providers

Hospitals and health systems

Ambulatory surgery centers

Multi-specialty clinics

Strengthen Your Revenue Cycle with Expert Credit Balance Services

Accurate credit balance management is essential for maintaining financial stability and regulatory compliance. With our expert credit balance services, healthcare providers can eliminate revenue leakage, reduce risk, and improve financial transparency.

If you are looking to streamline your credit balance process and protect your practice’s revenue, partnering with an experienced credit balance service provider is a strategic step toward long-term success.