Створення магазину BBR: від ідеї до мережі спортивного харчування в Дніпрі

Як Данило Лупандін створив мережу магазинів спортивного харчування BBR у Дніпрі - реальна історія від перших продажів до чотирьох точок та доставки по Україні.

Як Данило Лупандін створив мережу магазинів спортивного харчування BBR у Дніпрі - реальна історія від перших продажів до чотирьох точок та доставки по Україні.

Щедра душа, чуйна - і безсердечна, розум і божевілля - це все властивості тієї ж душі. Незламна, бунтівна, але, дивишся, вона вже плазує, догоджає… Душа такого народу завжди загадкова тим, хто живе за межами Широкої Землі.

Більшість VPN-додатків за замовчуванням налаштовані на оптимальну швидкість та зручність, щоб користувачі могли швидко розпочати роботу без зайвих складнощів. Однак коли йдеться про критично важливу приватність, стандартних налаштувань може бути недостатньо.

Green та red flags чоловіки. Книги знають і тих, і тих. Але хто матиме більше зоряного часу? Говоримо про перспективи головних героїв.

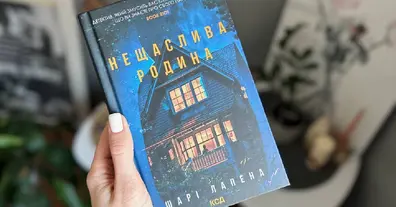

У родині Мертонів усі мають таємниці — навіть мерці. Після родинної вечері Фреда знаходять зарізаним, а його дружину Шейлу — задушеною у власному маєтку. І дуже швидко стає зрозуміло: це хтось зі своїх. Бо мотив тут є майже в кожного.

Воістину рідко трапляється загін, здатний довго битися в умовах нескінченного кровопролиття Нічийної землі без допомоги могутнього покровителя. Не вижити там без припасів, підкріплень та озброєння, відтак більшість загонів присягають на відданість тим чи іншим повелителям.

В той день, коли ти нарешті наважишся мене вбити, скоріше за все я не буду опиратись...

Власники американських активів мають змиритися з цим.

Карколомний розвиток політичних подій на протязі 2025 і на початку 2026 років заганяє в ступор. Інформаційний простір переповнений припущеннями експертів. Припущеннями, бо передбачуваність в глобальній політиці розчинилася в хаосі заяв і безвідповідальних дій політиків…

Багато хто починає з «автомата», але водіння на механічній коробці передач залишається корисним навиком.

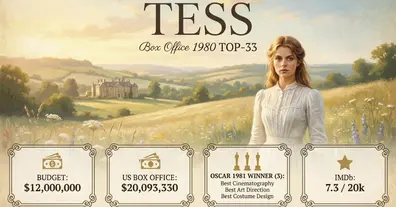

Детальний аналіз фільму «Тесс» (Tess) 1979 року. Це унікальний приклад у кінобізнесі: найдорожчий французький фільм свого часу, знятий польським режисером-вигнанцем англійською мовою, який став світовим хітом

Аналіз спроб МОЗ монополізувати ринок інноваційного лікування через призму історичного досвіду ліцензування в Україні. Чому «нові будинки» не рятують від «старих забобонів».

Ось найчастіше повторюване відкриття, зроблене в моїй галузі психології за останнє десятиліття: більшість людей вважають, що страждають від хронічної "страннінькості".

У вівторок, 24 лютого, Рада ЄС із загальних питань схвалила два рішення, що відкривають шлях до продовження технічної підготовки для надання Україні кредиту обсягом 90 млрд євро

Ви всього лиш за 1 крок від персональної стрічки і повного функціоналу Друкарні

Світова політика

той, котрий складає вірші

Trench Crusade українською

Кібербезпека простою мовою

Аналіз касових зборів фільмів